Case Study 4:

SEO Services

Overview

Our client is a Calgary-based digital insurance provider specializing in professional liability solutions for Canadian professionals and small businesses. Operating through a fully online platform, the company offers a streamlined process that allows clients to obtain quotes, purchase policies, and receive documentation within minutes, eliminating the need for traditional broker interactions.

The firm provides a range of insurance products, including Professional Liability Insurance (also known as Errors & Omissions), Commercial General Liability, Cyber Liability, and Directors & Officers Liability coverage. These offerings cater to a diverse clientele across various sectors such as IT, engineering, consulting, photography, social services, and legal professions.

With its headquarters situated in Calgary, the company serves clients nationwide, maintaining a strong presence in major urban centers including Toronto, Vancouver, Edmonton, and Ottawa.

The client’s value proposition centers on providing accessible, affordable, and comprehensive liability coverage tailored to the unique needs of professionals. This approach has positioned them as a preferred choice for individuals and businesses seeking efficient and reliable insurance solutions.

Objectives and Challenges

Despite offering a highly valuable digital insurance service, the client faced significant SEO-related hurdles that limited their online visibility and organic traffic growth. The primary challenges were as follows:

1. A Highly Competitive Online Landscape

The digital insurance market in Canada is saturated with well-established players and aggregators with strong domain authority, extensive content portfolios, and aggressive paid advertising strategies. Competing against national insurers and lead-generation platforms for high-converting keywords required a sophisticated and strategic SEO approach. The client’s relatively niche focus—liability insurance for professionals—added complexity, as even those long-tail keywords were targeted by competitors with larger budgets and teams.

2. Limited Opportunities for Local SEO Traffic

As an online-only service headquartered in Calgary but serving all of Canada, the client faced a unique challenge: they could not fully capitalize on local SEO tactics. Traditional local optimization strategies like Google Business Profile listings or localized landing pages had limited value, as the service didn’t depend on foot traffic or physical office visits. This restricted their ability to rank in local map packs or benefit from proximity-based search queries, especially when competing with brick-and-mortar insurance agencies.

3. High Keyword Difficulty in the Industry

The insurance sector is notorious for its keyword difficulty, with terms like “professional liability insurance,” “errors and omissions insurance,” and “cyber liability coverage” commanding high competition and CPC rates. Ranking for these terms organically required both substantial on-site optimization and a sustained effort in content creation and link acquisition. The client’s challenge was to establish topical authority in a space dominated by older, more authoritative domains.

These challenges shaped a focused set of SEO objectives: to improve organic visibility for high-intent keyword clusters, increase relevant traffic across Canada (with an emphasis on key provinces), and strengthen the site’s overall domain authority to better compete in organic search results.

Our SEO Services

Explore the range of SEO solutions we provide to protect what matters most.

Services Provided

To address the client’s SEO challenges and capitalize on growth opportunities, a comprehensive, multi-tiered SEO strategy was deployed. This involved a blend of SEO technical optimization, strategic content planning, and authority-building through backlinks. Key services included:

Implementation Process

The SEO strategy for the client was executed in clearly defined phases, each targeting a specific layer of search visibility and performance optimization. The following initiatives formed the backbone of the implementation process:

Results and Outcomes

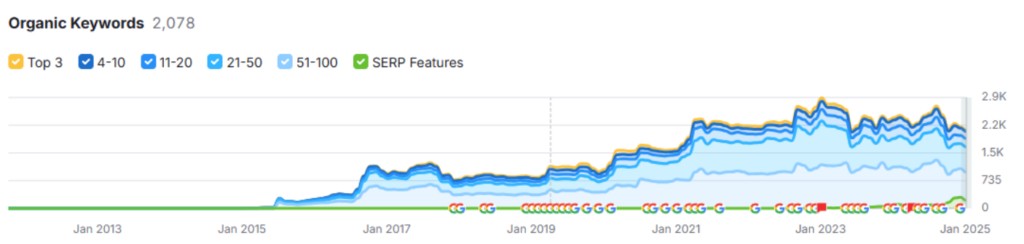

Steady Growth in Organic Keyword Visibility

A snapshot from SEMrush shows a consistent increase in the number of organic keywords the client ranks for on Google over an 8+ year period—highlighting long-term SEO success.

( Source: SEMRush )

Year-over-Year Growth in Organic Traffic & Engagement

Google Analytics 4 data reveals strong YoY growth across both organic sessions and engaged user activity, demonstrating improved traffic quality and user retention.

(Source: Google Analytics 4)

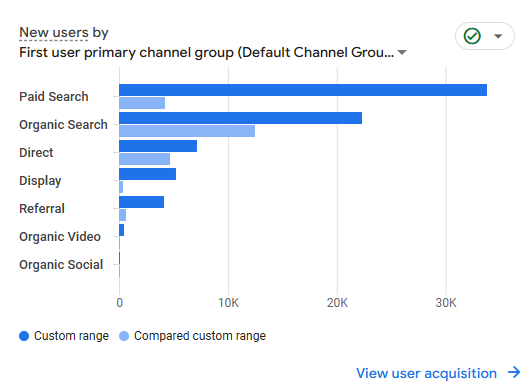

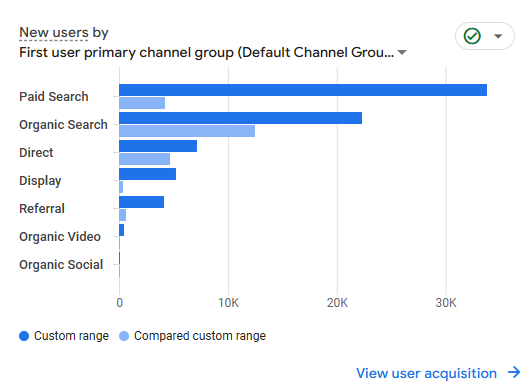

Organic Traffic: A Leading Source of Conversions

Organic search has become one of the top traffic drivers, consistently delivering high-quality visits and outperforming most non-paid sources.

(Source: Google Analytics 4)

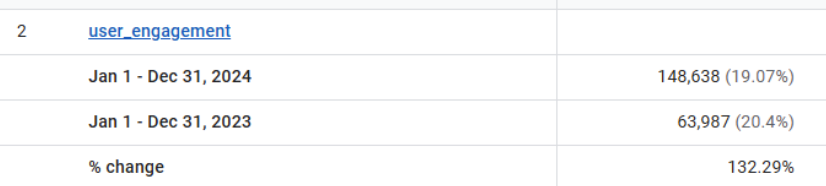

User Engagement More Than Doubled

A key engagement metric—engaged sessions—rose by over 100% YoY, reflecting stronger on-site interaction and content relevance.

(Source: Google Analytics 4)

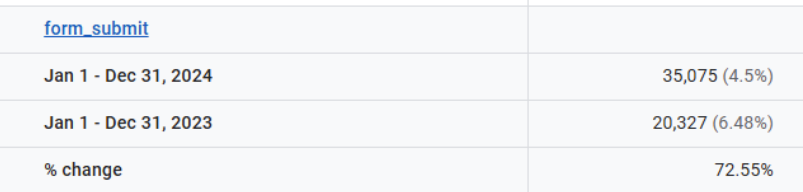

Form Submissions Up by 72% Year-over-Year

Lead generation efforts saw significant gains, with a 72% increase in form submissions, directly translating into more qualified inquiries.

(Source: Google Analytics 4)

Policy Purchases Increased by 144% YoY

As the primary conversion goal, policies purchased saw a remarkable 144% year-over-year jump, validating the success of the targeted SEO strategy.

(Source: Google Analytics 4)

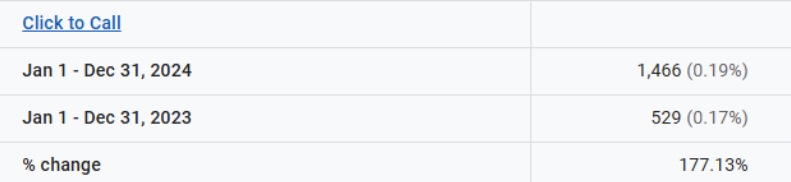

Calls from Website Visitors Surged 177%

Phone inquiries, an important direct engagement metric, grew by 177% YoY, reflecting increased buyer intent and trust in the service.

(Source: Google Analytics 4)

SEO Services: FAQs

Absolutely. Trufla Technology’s specialized SEO services for insurance brokers are designed to enhance your online visibility, making it easier for potential clients to find your liability insurance offerings. By targeting specific keywords and optimizing your website content, Trufla helps attract more qualified leads, ultimately increasing your sales .

Yes, SEO can attract more qualified leads for high-value commercial policies. Trufla’s targeted keyword research and content optimization strategies are designed to draw in visitors actively seeking comprehensive insurance solutions for their businesses, thereby increasing the quality and quantity of your leads .

Yes, investing in SEO for niche insurance products like Errors & Omissions (E&O) or commercial liability is highly beneficial. Trufla’s expertise in the insurance sector allows for the development of targeted SEO strategies that effectively reach audiences seeking these specialized services, often resulting in higher conversion rates .

Implementing local SEO strategies is crucial for ranking in location-specific searches. Trufla optimizes your website for local keywords, enhances your Google My Business profile, and creates location-specific content, all of which contribute to improved rankings for searches like “liability insurance quotes” in your area .

Key strategies include:

- Keyword Research: Targeting industry-specific and location-based keywords.

- On-Page SEO: Optimizing title tags, meta descriptions, headers, and content.

- Technical SEO: Improving site speed, mobile-friendliness, and crawlability.

- Local SEO: Optimizing Google My Business and local citations.

- Content Marketing: Creating blogs, FAQs, and guides.

- Link Building: Earning authoritative backlinks to boost credibility.

Creating informative content and blog posts establishes your authority in the insurance industry and builds trust with potential clients. Trufla’s content development strategy focuses on addressing common questions and providing valuable insights, guiding visitors through the decision-making process and increasing the likelihood of converting them into policyholders .

The time it takes to see SEO results for new website depends on several factors, including the site’s current authority, competition, and the effectiveness of the SEO strategy. Generally, noticeable improvements can take 8 to 10 months, while significant traffic and ranking boosts may take 14 to 20 months or longer.