Driving Broker

Retention through

Data and AI

Solutions

BACKGROUND

Sharp Insurance is a leading provider of

home and auto policies in Canada, with the

brokerage writing $5M in home (+8500

policies), $30M+ million in auto (+11,000 policies),

and $10M+ in premium. Sharp’s goal is

to enhance their client relationships,

streamline processes, and boost retention rates.

CHALLENGE

One of the primary challenges Sharp

Insurance faced was its retention rates.

Like many brokerages, they did not have

the time, nor the resources, to pull every

renewal to calculate rate changes. They

needed to automate and optimize their

renewal processes to increase

their retention numbers.

SOLUTION

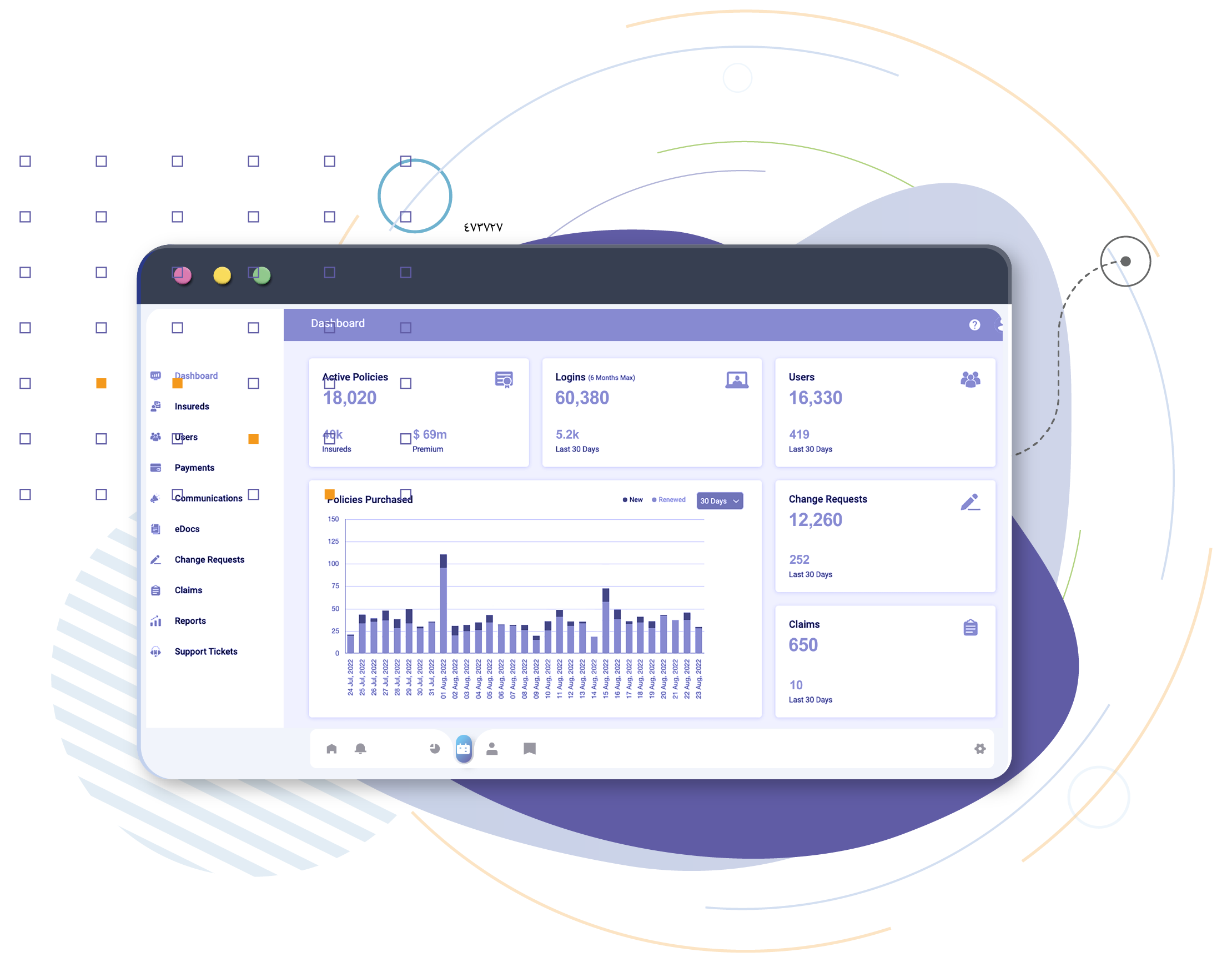

Sharp Insurance implemented truMobile,

and had over a 90% user adoption in the first year.

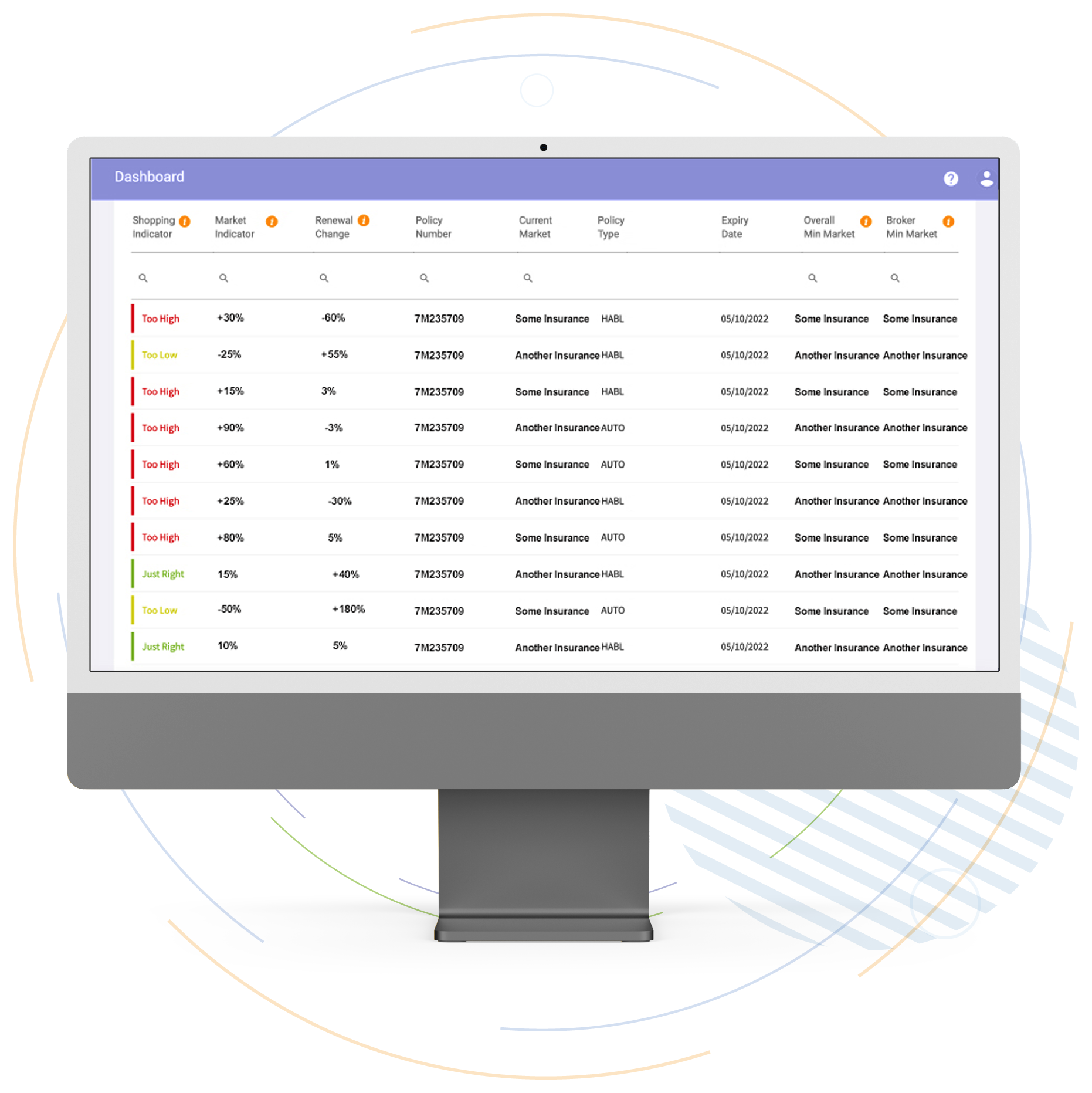

Using Broker X-Ray to identify high

cancellation risk clients, Sharp Insurance was

able to focus their resources and client

communication all within the truMobile tool. The

result was an increase in retention and

optimizing their resources and workflow

management.

ONE-STOP

LEAD MAGNET

Your truweb website will steer your clients

towards painless, quick decision making that

matches their exact insurance needs. Turn your

leads into long-term customers, instead of a

bounce rate statistic.

KEY FEATURES OF

TRUMOBILE:

01

DATA-DRIVEN

INSIGHTS:

truMobile leverages advanced

analytics and data-driven

insights to provide brokers

with a deeper understanding

of their clients’ renewals. By

utilizing these insights, brokers

can tailor their offerings and

services to meet their clients’

specific requirements

effectively.

02

PERSONALIZED CLIENT

EXPERIENCES:

truMobile facilitates

personalized client

experiences by utilizing

intelligent algorithms and

machine learning. The solution

enables brokers to deliver

customized

recommendations, timely

notifications, and relevant

updates, fostering a stronger

connection and sense of value

for their clients.

03

EFFICIENT

COMMUNICATION CHANNELS:

truMobile integrates directly

with CISIO, enabling brokers to

efficiently communicate

through various channels,

such as email, push

notifications, and SMS, into

a unified platform. This allows

brokers to engage with their

clients seamlessly and

consistently across different

channels, ensuring effective

communication and client

satisfaction.

04

PROACTIVE RISK

MANAGEMENT:

truMobile incorporates

proactive risk management

tools that enable brokers to

identify potential risks and

offer appropriate solutions to

their clients. By taking a

proactive approach to risk

management, brokers can

demonstrate their

commitment to client

protection and build trust,

resulting in increased loyalty

and retention.

RESULTS

UPON IMPLEMENTING TRUMOBILE DATA TOOLS, SHARP INSURANCE EXPERIENCED

SIGNIFICANT IMPROVEMENTS IN CLIENT RETENTION RATES. THE KEY OUTCOMES INCLUDED:

01

INCREASED CLIENT RETENTION

truMobile’s data-driven insights and

personalized experiences have helped Sharp

strengthen their relationships with

clients. As a result, client retention rates

have increased by an average of 2%,

leading to improved long-term business

sustainability.

02

ENHANCED CLIENT SATISFACTION

The personalized experience and efficient

communication channels facilitated by

truMobile have resulted in higher levels of

client satisfaction. Clients appreciate the

tailored recommendations, timely updates,

and seamless communication, leading to

overall improved experiences.

03

IMPROVED CROSS-SELLING AND UPSELLING

truMobile’s data-driven insights have enabled Sharp to identify cross-selling and

upselling opportunities within their existing client base. By offering relevant additional products

or services, Sharp has been able to increase revenue streams, while providing

comprehensive coverage to their clients.

CLIENT

STATISTICS

HERE ARE THE STATISTICS FROM

A SAMPLE OF PAST CLIENTS WHO

IMPLEMENTED TRUMOBILE:

satisfaction with their broker-client relationship.

increase in retention, as high as 2%.

time savings related to staffing.

CONCLUSION

truMobile has proven to be a game-changing solution

for insurance brokers seeking to increase client

retention rates without additional headcount by

leveraging data-driven insights, delivering

personalized experiences, and streamlining

communication channels.

truMobile empowers brokers to build stronger

relationships, provide tailored solutions, and foster

client loyalty. Insurance brokers can significantly

improve their retention rates, drive business growth,

and secure long-term success.