AI and Machine Learning: A Faster, Smarter Future for Insurance Brokers

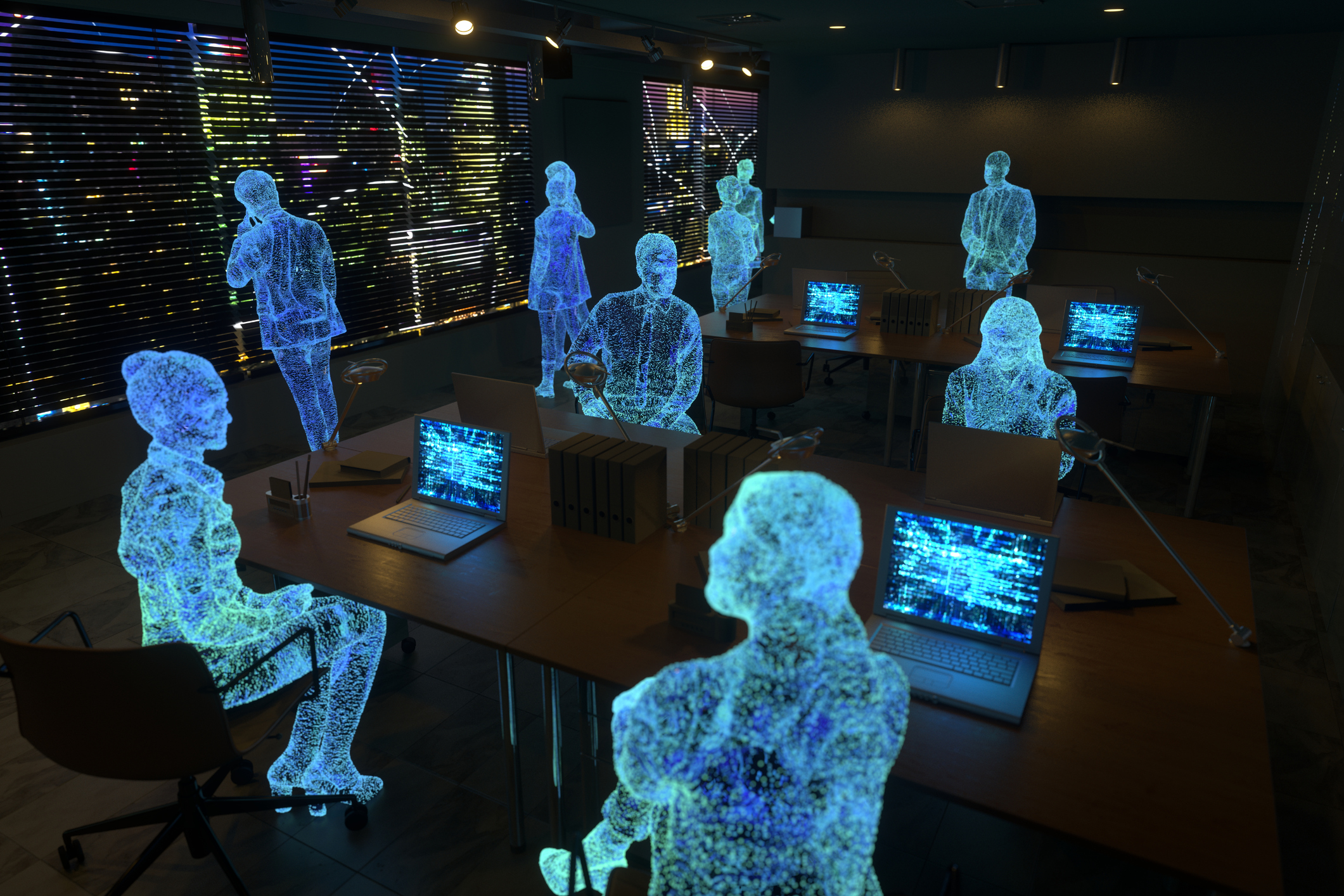

Businesses across the globe are undergoing an undeniable transformation when it comes to how they use data to optimise performance, and many of these businesses are already realising some of the vast potential AI technologies hold. As always, industries grow and evolve with every passing second, and with that, competition intensifies. The insurance industry is quickly catching up to the rising significance of AI and machine learning in today’s market. As an insurance broker, it’s important not to miss out on the many advantages AI, and specifically, machine learning could bring to your business.

How AI Is Being Used in Different Industries

The possibilities for AI in many industries are endless. Although it is a complex technology, many fields use AI, including energy, cybersecurity, automotive, and customer relations management. AI enables many helpful technologies like predictive maintenance, facial recognition, chatbots, fraud detection, and more.

How Can AI Improve Your Brokerage?

With the right data in sufficient amounts, you can use AI to take your brokerage to the next level. Using AI, you can provide a personalised experience for your customers. For example, you can give your existing customers recommendations for additional coverage they may need. You can also gain more customers by using personalised, targeted ads. Machine learning can also help you identify possible attempts for fraud or give you alerts for high-risk individuals signing up to your service.

Additionally, machine learning can allow you to automate processes like renewal or cancellation, and it can also assist in the automation of claims management. Utilising automation in business operations can help significantly increase the capacity of individual employees, thus increasing efficiency, reducing burnout, and enabling the reallocation of resources for new activities or sudden occurrences.

Chatbots, one of the most popular AI and machine learning applications, can help you up your customer service game by providing a more efficient experience, as they can respond instantly to customer questions or requests. Recently, applications like OpenAI’s ChatGPT have also soared in popularity because of the ease and speed with which they can generate and edit content and assist efficient brainstorming. If used correctly, these apps have the potential to enable businesses to produce SEO-optimised content for blogs, articles, or social media with accuracy, speed, and efficiency.

Authentication is another area in which AI and machine learning can be implemented to significantly increase your security precautions by using facial recognition technology.

Further down the line, machine learning, in cooperation with the Internet of Things (IoT), could enable dynamic insurance pricing, which will bring about better insurance prices and lower risks for insurance providers. These various applications of AI and machine learning can facilitate faster processes and cycles, thus enlarging your client base.

Getting Started with AI

As an insurance broker interested in utilising AI and machine learning, the first step is to talk to the experts. Before benefitting from services powered by AI, you must ensure that your data is sufficient and in the right format. It’s crucial to get your data from trusted sources to ensure it is of high quality and contains no errors, duplicates, or biased information, and to make sure the data undergoes the necessary preprocessing before use.

The amount of data you will need will depend on the application you intend to use it for. This is why it’s important to have a clear vision and specific goals for how you want to use AI technology and to not rush the process. Integrating AI and machine learning into your business is an investment, so it’s important to take time to evaluate the available options and choose what’s suitable for your brokerage in terms of scale and other future ventures.

Trufla Products to Lead Your Transition into AI

With a wide range of products, like truWeb and truMobile, Trufla can help you take the first step on the road to making your brokerage smarter and more efficient, with many features like automated marketing campaigns, third-party API integration, data retention, and access to larger data warehouses already in place, and more features to come. To further explore our products and services, contact us today.